PDI Reports 2015 Third Quarter and Nine Months Financial Results

| |

• | Entered into definitive asset purchase agreement to sell its Commercial Services business on November 2; Company to focus on molecular diagnostics business and change name to Interpace Diagnostics Group |

| |

• | Interpace Diagnostics test volume increases 13% over the 2015 second quarter |

| |

• | Continued diagnostics reimbursement momentum with managed care networks |

| |

• | Management reaffirms 2015 financial outlook for double-digit total company net revenue growth |

PARSIPPANY, N.J., November 12, 2015-- PDI, Inc. (NASDAQ: PDII) today reported financial and operational results for the third quarter and nine months ended September 30, 2015.

On November 2, the Company announced that it entered into a definitive asset purchase agreement with Publicis Healthcare Communications Group to acquire PDI’s Commercial Services business (CSO). This transaction is subject to PDI’s stockholder approval and is expected to close in the fourth quarter. The following financial results include PDI’s Commercial Services operations.

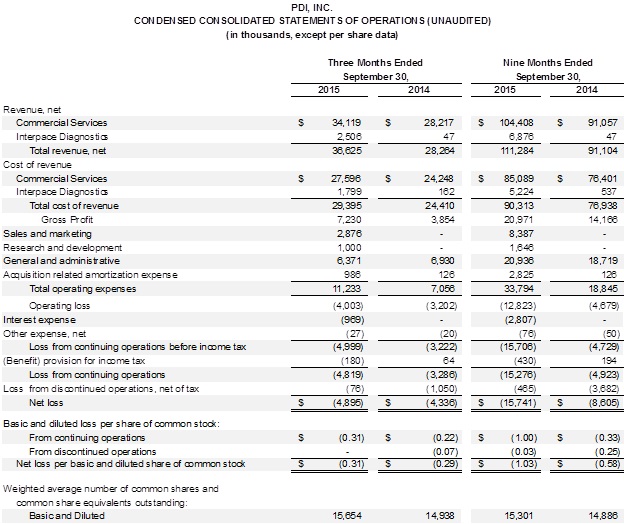

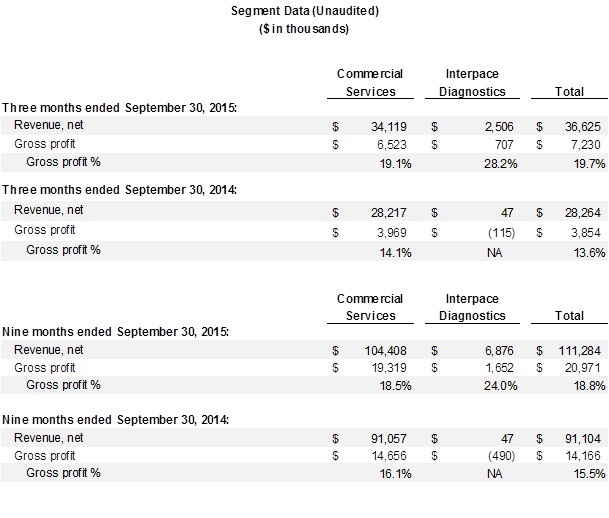

Net revenue for the third quarter of 2015 was $36.6 million, an increase of 29% over $28.3 million in the third quarter of 2014. Net revenue from Commercial Services was $34.1 million for the third quarter of 2015, an increase of approximately 21% over the previous year. Interpace Diagnostics net revenue was $2.5 million for the third quarter of 2015, up 11% sequentially from the second quarter of 2015. Most of the net revenue generated by Interpace Diagnostics was from PancraGEN™ testing given the anticipated lag in collections from the recently launched ThyGenX® and ThyraMIR™ thyroid tests. PDI recognized limited revenues from Interpace Diagnostics during the third quarter of 2014 because PDI’s principal diagnostic assets were acquired in the fourth quarter of 2014.

Gross profit for the third quarter of 2015 was $7.2 million, or 19.7% of net revenue, as compared to $3.9 million, or 13.6% of net revenue in 2014, reflecting the positive contribution of Interpace Diagnostics revenue. Total operating expenses for the period were $11.2 million as compared to $7.1 million for the same period in 2014 due primarily to investment spending related to the Company's Interpace Diagnostics business. The loss from continuing operations before income tax for the third quarter of 2015 was $5.0 million as compared to $3.2 million for the third quarter of 2014.

“We believe that our recently announced plan to focus our energy and resources entirely on our expanding molecular diagnostics business, along with the implementation of numerous cost efficiencies will build long term value for our shareholders. With our improved balance sheet following the close of the deal, we plan to be able to further develop our commercial capabilities as well as bring new products to market, namely BarreGen for Barrett’s Esophagus, which we plan to launch in 2016,” commented Nancy Lurker, President and Chief Executive Officer of PDI.

“In the third quarter, the combined test volume for our three commercialized molecular diagnostics showed a sequential increase of 13%, including 36% growth from our thyroid tests, building off the momentum from our three managed care wins over the summer months,” Ms. Lurker added. “However, we face some challenges that are delaying our revenue growth, primarily with the PancraGen test. We are executing strategies to address these challenges and believe that PancraGen remains an important test in the diagnosis and prognosis of pancreatic cancer risk. In addition, our recently launched thyroid nodule molecular diagnostic tests are growing at a faster rate than our peers. This growing market acceptance can be directly attributed to the strong clinical validity and utility results published in peer review journals illustrating the patient benefits of ThyraMIR and ThyGenX. We are building traction in the marketplace for

all of our molecular diagnostic tests, producing impressive data flow, maintaining a presence at major medical conferences and increasing coverage of our tests from multiple large, national payers.

Recent Operational Highlights

Progress Report

| |

• | On November 2, the Company announced a definitive agreement to sell its commercial services business to Publicis Healthcare Communications Group. PDI will use the proceeds of the deal, worth up to approximately $33 million in an upfront payment, $7 million of which is contingent upon securing certain CSO client commitments, and a future contingent earnout payment based upon 2016 CSO revenue (expected to range from $5 million to $15 million), to pay down debt and to focus on its expanding molecular diagnostics business. The Company expects to close the deal during the fourth quarter. |

| |

• | The combined molecular diagnostic tests ordered during the third quarter were approximately 2,200, an increase of 13% over the 2015 second quarter. Thyroid tests ordered grew 36% as compared to the second quarter level. |

| |

• | In July, Interpace Diagnostics' Thyroid Mutation Panel, ThyGenX™, was approved by Aetna for coverage of fine needle aspiration (FNA) samples from indeterminate thyroid nodules. The Company was also awarded additional managed care contracts for both its GI and Thyroid tests. These networks include CareFirst BlueCross Blue Shield for Thyroid, and the entire Humana network for PancraGEN . The total number of covered lives for Interpace Diagnostics products is now 109 million for all tests combined. |

Publications and Presentations

| |

• | On October 19, Interpace Diagnostics presented two posters during the American College of Gastroenterology (ACG) Annual Scientific Meeting and Postgraduate Course. The first poster was a clinical utility study demonstrating that PancraGEN provides a more optimal negative predictive value (NPV) than the 2015 American Gastroenterological Association (AGA) guideline criteria, detecting nearly 80% of the malignancies missed by the newly proposed criteria. This was without compromise to the improved positive predictive value (PPV) proposed by AGA. This work received one of the prestigious ACG Presidential Poster Awards. Results of the second analysis demonstrated that initial PancraGEN testing is predictive of future clinical management decisions that, importantly, benefit patient outcomes more than solely relying on guideline recommended use imaging and cytology testing. |

| |

• | On October 21, Interpace Diagnostics also presented new data at the 15th International Thyroid Congress and 85th Annual Meeting of the American Thyroid Association. The results demonstrated that combination testing by ThyGenX® and ThyraMIR has been analytically validated on cytology slides and Thin Prep slides as well as fixed nodule specimens including Formalin Fixed Paraffin Embedded samples, in addition to the current molecular analysis of fine needle aspirations. Interpace Diagnostics is the only molecular diagnostics company offering validated testing of thyroid nodules on all four forms of pathology samples. These results further validate the utility of the combined tests of ThyGenX oncogene panel using Next Generation Sequencing, and ThyraMIR miRNA classifier. |

| |

• | Additionally, a manuscript regarding how PancraGen can be used to lengthen surveillance intervals and avoid unnecessary surgeries in patients with pancreatic cysts is expected to be accepted by the Journal of Clinical Gastroenterology (JCG) for publication. |

2015 Financial Guidance

| |

• | PDI reaffirms total company-wide 2015 net revenue of $136 million to $140 million based on the sale of our CSO business closing near the end of 2015. |

| |

• | Interpace Diagnostics 2015 net revenue of approximately $9 to $10 million. |

| |

• | Company-wide 2015 gross margin of approximately 18%, up from 15.5% in 2014. |

| |

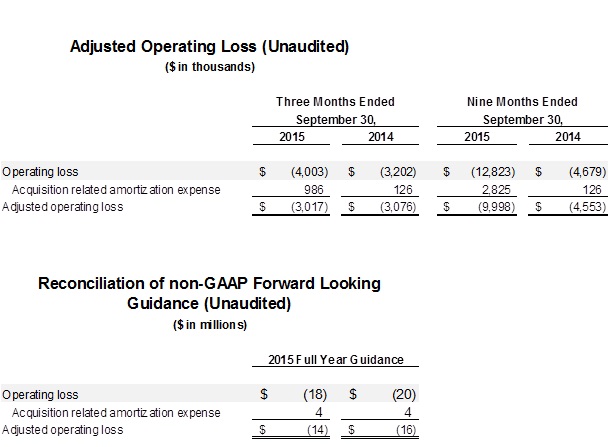

• | 2015 adjusted operating loss (as defined below) is now expected to be $14 million to $16 million as compared with the previous forecast of $16 million to $18 million. A reconciliation of adjusted operating loss (a non-GAAP financial measure) to operating loss is provided later in this press release. |

2015 Nine Month Results

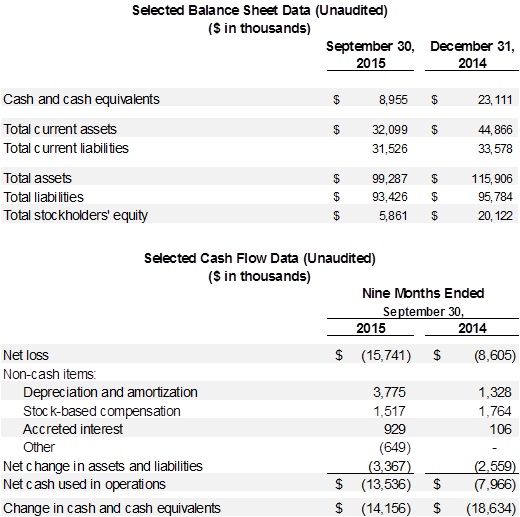

Net revenue for the nine months ended September 30, 2015 was $111.3 million, an increase of 22% over $91.1 million in the same period in 2014. Net revenue from Commercial Services was $104.4 million, an increase of approximately 15% from the nine months ended September 30, 2014, and Interpace Diagnostics net revenue was $6.9 million. Gross profit for the nine months of 2015 was $21 million, or 18.8% of net revenue, as compared to $14.2 million, or 15.6% of net revenue in same nine month period of 2014. Total operating expenses for the nine months ended September 30, 2015 were $33.8 million as compared to $18.8 million for the same period in 2014 due primarily to investment spending and ramp up related to the company's molecular diagnostic strategic initiative. The loss from continuing operations before income tax for the nine months ended September 30, 2015 was $15.7 million versus $4.7 million for the same period in 2014. The adjusted operating loss for the nine months ended September 30, 2015 was $10.0 million as compared to $4.6 million from the same period in 2014.

Conference Call

PDI management will host a conference call today, Thursday, November 12, 2015 at 4:30 p.m. ET to discuss financial and operational results for the third quarter ended September 30, 2015. The dial-in number for the conference call is 877-407-8037 (U.S. and Canada callers), and 201-689-8037 for international participants.

Investors can also access a webcast of the live conference call by linking through the investor relations section of the PDI-Inc. website, at www.pdi-inc.com. The teleconference replay will be available two hours after completion through November 19, 2015 at 877-660-6853 (U.S. and Canada) or 201-612-7415. The replay passcode is 13623822. The archived web cast will be available for one year on the company's web site, www.pdi-inc.com, under "Investor Relations."

Non-GAAP Financial Measures

In addition to the United States generally accepted accounting principles (GAAP) results, we disclose certain non-GAAP financial measures. A "non-GAAP financial measure" is defined as a numerical measure of a company's historical or future financial performance, financial position or cash flows that excludes (or includes) amounts, or is subject to adjustments that have the effect of excluding (or including) amounts, that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in a company's financial statements. Management does not intend the presentation of non-GAAP financial measures to be considered in isolation or as a substitute for results prepared in accordance with GAAP.

Management believes that these non-GAAP financial measures, when presented in conjunction with comparable GAAP financial measures, are useful to both management and investors in analyzing our ongoing business and operating performance. Management believes that providing non-GAAP information to investors, in addition to the GAAP presentation, allows investors to view our financial results in the way that management views financial results.

In this press release, we discuss Adjusted Operating Loss, a non-GAAP financial measure defined as operating loss from continuing operations excluding amortization expense of acquisition related intangible assets and other fair value adjustments. A reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure is presented in the table attached to this news release.

About PDI, Inc.

PDI is a leading healthcare commercialization company providing go-to-market strategy and execution to established and emerging pharmaceutical, biotechnology, diagnostics and healthcare companies in the United States through its Commercial Services business, and developing and commercializing molecular diagnostic tests through its Interpace Diagnostics business. PDI's Commercial Services business is focused on providing outsourced pharmaceutical, biotechnology, medical device and diagnostic sales teams to its corporate customers. PDI's Interpace Diagnostics business is focused on developing and commercializing molecular diagnostic tests, leveraging the latest technology and personalized medicine for better patient diagnosis and management. For more information about us, please visit www.pdi-inc.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, relating to our future financial and operating performance. PDI has attempted to identify forward looking statements by terminology including "believes," "estimates," "anticipates," "expects," "plans," "projects," "intends," "potential," "may," "could," "might," "will," "should," "approximately" or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are based on current expectations, assumptions and uncertainties involving judgments about, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond PDI's control. These statements also involve known and unknown risks, uncertainties and other factors that may cause PDI's actual results to be materially different from those expressed or implied by any forward-looking statement. Known and unknown risks, uncertainties and other factors include, but are not limited to, the closing of the sale of our CSO business, our ability to adequately finance the business, the market's acceptance of our molecular diagnostic tests; projections of future revenues, growth, gross profit and anticipated internal rate of return on investments; the loss, early termination or significant reduction of any of our existing service contracts; the failure to meet performance goals in PDI's incentive-based arrangements with customers; the inability to secure additional business; or our inability to develop more predictable, higher margin business through sales of our molecular diagnostic tests, in-licensing or other means. Additionally, all forward-looking statements are subject to the risk factors detailed from time to time in PDI's periodic filings with the Securities and Exchange Commission (SEC), including without limitation, the Annual Report on Form 10-K filed with the SEC on March 5, 2015 and in PDI's Form 10-Q filed with the SEC on August 14, 2015. Because of these and other risks, uncertainties and assumptions, undue reliance should not be placed on these forward-looking statements. In addition, these statements speak only as of the date of this press release and, except as may be required by law, PDI undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

ADDITIONAL INFORMATION ABOUT THE PROPOSED SALE OF THE COMPANY'S COMMERCIAL SERVICES BUSINESS AND WHERE TO FIND IT

The Company has entered into a Asset Purchase Agreement, dated October 30, 2015 (the “Asset Purchase Agreement”), with Publicis Touchpoint Solutions, Inc., an indirect wholly owned subsidiary of Publicis Groupe S.A. (the “Buyer”), pursuant to which the Company will sell to the Buyer substantially all of the assets, the goodwill and ongoing business comprising the Company’s Commercial Services business and the Buyer will assume certain specified liabilities, upon the terms and subject to the conditions of the Asset Purchase Agreement (the “Asset Sale”). The Company intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement and other relevant materials with respect to a special meeting of the stockholders. The proxy statement will be mailed to the stockholders of the Company. Investors and stockholders of the Company are urged to read the proxy statement and the other relevant materials when they become available because they will contain important information about the Company, the Buyer and the Asset Sale. The proxy statement and other relevant materials (when they become available), and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and stockholders may obtain free copies of the documents filed with the SEC by the Company by directing such requests to PDI, Inc., Attention: Chief Financial Officer, Morris Corporate Center I, Building A, 300 Interpace Parkway, Parsippany, NJ 07054, telephone number (800) 242-7494. Investors and stockholders of the Company are urged to read the proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction.

PARTICIPANTS IN THE SOLICITATION

The Company and its directors and executive officers may, under SEC rules, be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the Asset Sale.

Investors:

Chris Dailey/Michael Polyviou

EVC Group, Inc.

(646) 445-4800

cdailey@evcgroup.com