For

more information contact:

Stephen

P. Cotugno

Executive

Vice President-Corporate Development

PDI,

Inc.

201.574.8617

PDI,

Inc. Reports Third Quarter and Nine Month 2006 Financial Results

And

Comments on Recently Completed Strategic Plan

PDI

Board Approves Common Stock Repurchase Program

Saddle

River, New Jersey (November 7, 2006). PDI, Inc. (NASDAQ: PDII) a contract sales

and marketing services provider to the pharmaceutical industry, today announced

its third quarter and nine month 2006 financial results and a common stock

repurchase program and commented on its recently completed strategic

plan.

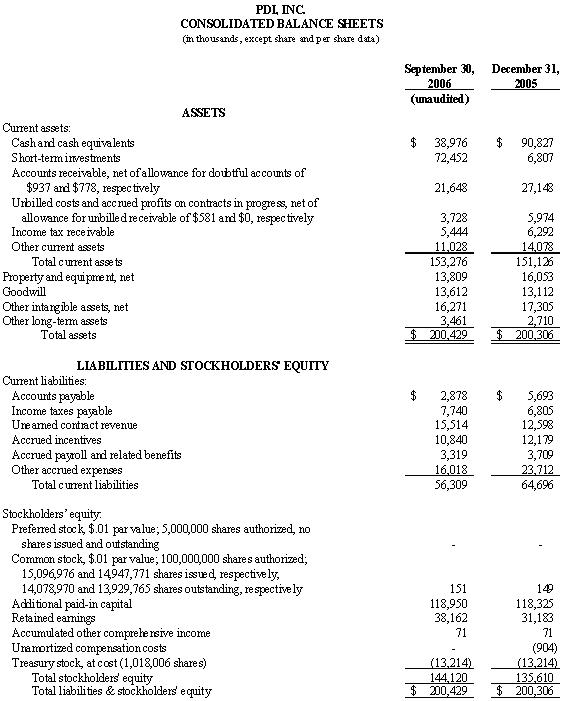

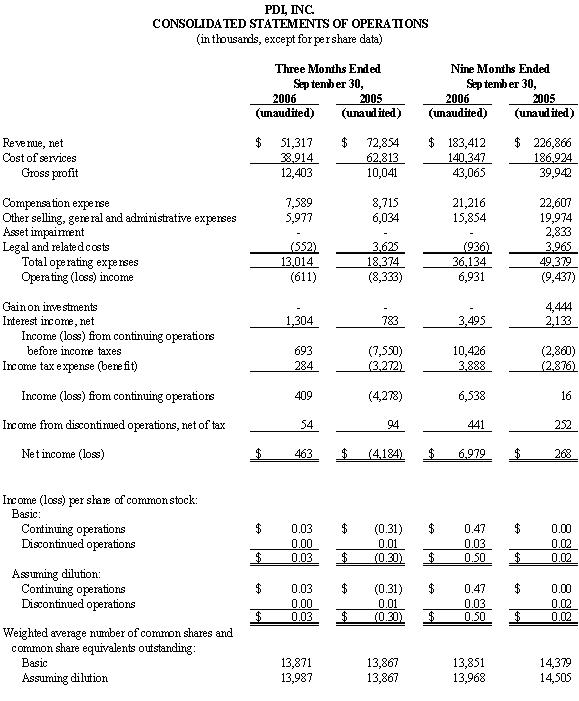

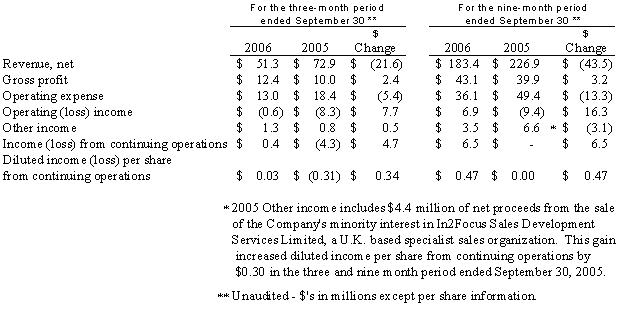

Continuing

Operations

Results

from continuing operations were:

Financial

Highlights

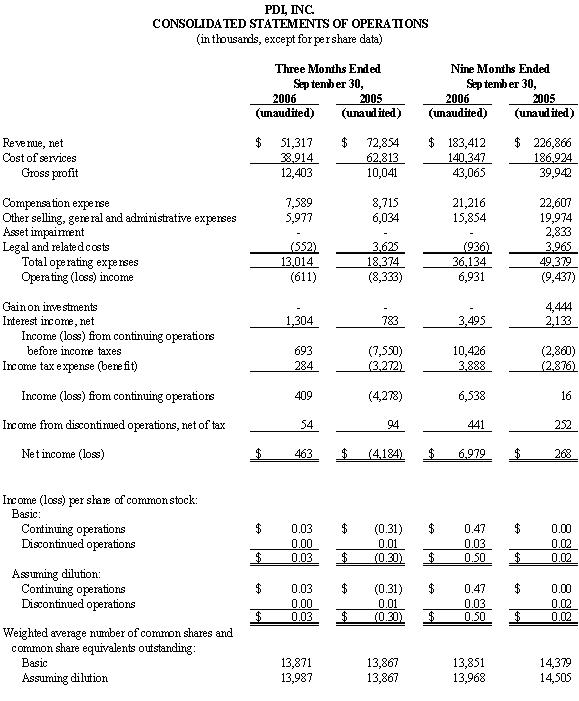

Revenue

-

Net

revenue was lower in the third quarter and nine months of 2006 compared to

2005

primarily attributable to the scaling down, completion or termination of certain

contracts in the Company’s Sales Services segment, including the previously

announced termination of a major contract as of April 30, 2006. New contracts

and expanded business with existing clients in this segment partially offset

these declines. Overall revenue in the Marketing Services segment declined

slightly in the third quarter and nine months of 2006 despite increased

Pharmakon revenue.

Gross

profit

-

Despite lower net revenue, gross profit was higher in both Sales Services and

Marketing Services for the third quarter and nine months of 2006 compared to

2005. Sales Services gross profit was higher in 2006 due to non-recurring

benefits in connection with the close out of the major contract terminated

in

April, as well as improved gross profit margins on new business. Gross profit

and the gross profit percentage for the first nine months of 2006 were

negatively impacted by approximately $1.2 million of start up costs in

connection with a new contract sales engagement with a major pharmaceutical

company announced on May 11, 2006, and approximately $1.4 million due to a

delay

in revenue recognition on a contract sales engagement because of uncertainty

regarding collection. Marketing Services gross profit was higher for the third

quarter and nine months in 2006 due to margin improvements in both Pharmakon

and

Vital Issues in Medicine (VIM).

Operating

Expenses

-

Operating expenses were significantly lower for the third quarter and nine

months of 2006 compared to 2005. Total operating expenses for the third quarter

and nine months of 2006 include lower compensation costs of $1.1 million and

$1.4 million, respectively, primarily due to lower severance, and lower legal

and litigation costs, net of recoveries of $4.2 million and $4.9 million,

respectively. Nine month operating expenses in 2005 also included a $2.8 million

charge for the write-down of a sales force automation system and a $0.8 million

reserve established for an outstanding loan.

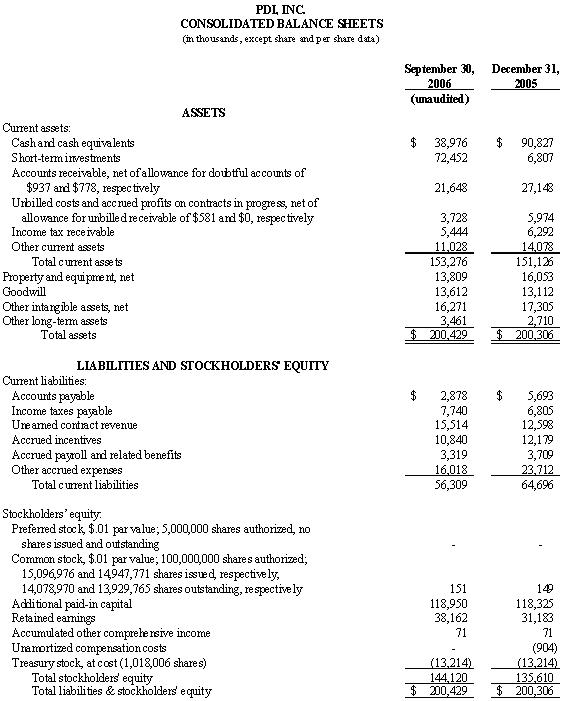

Liquidity

and Cash Flow

Cash

and

short-term investments on September 30, 2006 were $111.4 million. Cash flow

from

operating activities for the third quarter and nine months of 2006 were $4.5

million and $15.8 million, respectively, compared to $(0.6) million and $2.0

million for the comparable periods in 2005.

Common

Stock Repurchase Program

The

Board

of Directors has authorized the Company to repurchase up to one million shares

of its common stock.

The

Company intends to repurchase shares on the open market or in privately

negotiated transactions, or both. Some or all of the repurchases will be made

pursuant to a Company 10(b)5-1 Plan that the Company will adopt. All purchases

will be made from the Company’s available cash. The Board of Directors also

terminated a share repurchase plan authorized in 2005.

CEO

Commentary

Mr.

Michael Marquard, PDI’s CEO stated, “The financial results for the third quarter

show us to be marginally profitable at our current level of business. The recent

non-renewal of two major contracts will have an impact beginning in the fourth

quarter of 2006 and

unless and until we generate sufficient Sales Teams new business to offset

the

loss of these two programs, we expect our financial results to be weaker in

the

near term. While we are currently not providing forward earnings guidance,

taking into account the loss of these two contracts and our continuing cost

reduction efforts, without any new business included, our current estimate

for

2007 would be for negative cash flow of no more than $10 million.”

“The

current pipeline of opportunities for our dedicated contract sales service

has

increased nicely from the second quarter. We are optimistic about converting

some of these opportunities into new business, including some in the near term

that could facilitate redeploying some of our experienced sales representatives

from programs that are winding down.”

“Since

early 2006, we have experienced a significant amount of change in our business.

In today’s environment, many large pharmaceutical companies are reevaluating

their commercial sales model, which has resulted in changes in their outsourcing

partnerships. PDI has been particularly impacted due to our historical success

within Big Pharma. Going forward, we believe that the sales representative

remains central to successful product commercialization. We believe that

outsourcing sales capacity will increase as speed to market, flexibility, and

cost effectiveness in the deployment of sales forces will increase in importance

within both big and emerging pharmaceutical companies as they introduce new

products and respond to opportunities and competitive threats to their in-line

products.”

“We

have

recently completed our strategic planning process. The strategic plan has

received Board input and support and reiterates our commitment to the contract

sales market. It further outlines initiatives to regain our position as the

largest provider of contract sales representatives. It is also our mission

to

become a leading provider of commercialization services to the pharmaceutical

industry. To

regain

market leadership within our Sales Services Segment, we plan to further

strengthen our business development efforts, deliver flawless sales force

execution and create innovative and distinctive contract sales offerings aligned

with evolving Big Pharma and Emerging Pharma needs. This will lead to

distinctive and compelling offerings and a broader range of

services.”

“In

our

Marketing Services segment, we plan to grow our current services, and expand

our

offerings through acquisitions or internal development. We plan to acquire

or

build commercial services that strengthen CSO offerings and advance our efforts

within emerging pharmaceutical companies who value a single point of contact

for

a breadth of services that enable them to successfully commercialize their

products. These services will diversify our business by providing additional

revenue and profit potential and expand our customer base for cross selling

opportunities.”

“I

am

pleased to announce that our Board of Directors has also authorized us to begin

purchasing up to 1,000,000 shares under our newly adopted share buyback program.

We believe that our current stock price, execution of this program is a wise

use

of our cash.”

“Contract

sales services are critical to our strategic focus today and will remain so

in

the future. We

believe the opportunities ahead are exciting and that we have a strong plan

in

place to reinvigorate and grow our company. I

am

confident that we have the people, the resources and a sound plan to realize

our

goals.”

PDI

Announces Dismissal with Prejudice of Securities

Litigation

On

November 2, 2006, the United States District Court for the District of New

Jersey dismissed with prejudice the Third Consolidated and Amended Class Action

Complaint in connection with the lawsuit In re PDI Securities Litigation (Civil

Action No.: 02-cv-0211-JLL). The action was originally filed in January 2002

against PDI, its former CEO and former CFO. The District Court issued an opinion

and order dismissing with prejudice all claims asserted in the Third Amended

Complaint against all defendants and denied plaintiffs request to amend the

complaint.

Conference

Call Information

PDI

will

conduct a briefing of its results via conference call and webcast on Wednesday,

November 8, 2006 at 9:00 AM Eastern time. The webcast of the event will be

accessible through the Investor Relations section of PDI’s website, www.pdi-inc.com.

The

webcast will be archived on the website for future on-demand replay.

For

those

without internet access, the briefing can be accessed by dialing 1-877-423-4030

and asking for the PDI’s Third Quarter 2006 Financial Results Call. The call

playback will be available for two weeks by calling 1-800-642-1687 and entering

the call number 8303126.

About

PDI

PDI,

Inc.

(NASDAQ: PDII) is a contract sales and marketing services provider to the

pharmaceutical industry offering outsourced solutions for established and

emerging pharmaceutical companies. PDI is dedicated to maximizing the return

on

investment for its clients by providing strategic flexibility; sales, marketing,

and commercialization expertise; and a philosophy of performance.

Headquartered

in Saddle River, NJ, PDI operates in two segments; Sales Services and Marketing

Services. Our Sales Services include our Performance Sales Teams™, which are

dedicated teams for specific clients; and Select Access™, our targeted sales

solution that leverages an existing infrastructure. Our marketing services

include marketing research and consulting services through TVG in Dresher,

PA,

and medical communications services through Pharmakon in Schaumburg, IL. In

addition, PDI is a high quality provider of ACCME-accredited continuing medical

education through Vital Issues in Medicine (VIM ®) in Dresher, PA. The company’s

experience extends across multiple therapeutic categories and includes office

and hospital-based initiatives.

PDI’s

commitment is to deliver innovative solutions, unparalleled execution and

superior results for its clients. Through strategic partnership and

client-driven innovation, PDI maintains some of the longest standing sales

and

marketing relationships in the industry. Recognized as an industry pioneer,

PDI

remains committed to continuous innovation and to retaining the industry’s

highest quality employees.

For

more

information, visit the Company’s website at www.pdi-inc.com.

Forward-Looking

Statements

This

press release contains forward-looking statements regarding future events and

financial performance. These statements involve a number of risks and

uncertainties and are based on numerous assumptions involving judgments with

respect to future economic, competitive and market conditions and future

business decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond PDI's control. Some of the important

factors that could cause actual results to differ materially from those

indicated by the forward-looking statements are general economic conditions,

the

termination of or material reduction in the size of any of our customer

contracts, the loss by our clients of intellectual property rights, our ability

or inability to secure new business to offset the recent loss of customer

contracts and the terms of any replacement business we secure, changes in our

operating expenses, FDA, legal or accounting developments, competitive

pressures, failure to meet performance benchmarks in significant contracts,

changes in customer and market requirements and standards, the impact of any

stock repurchase programs, the adequacy of the reserves PDI has taken, the

financial viability of certain companies whose debt and equity securities we

hold, the outcome of certain litigations, PDI's ability to implement its current

and future business plans, and the risk factors detailed from time to time

in

PDI's periodic filings with the Securities and Exchange Commission, including

without limitation, PDI's Amended Annual Report on Form 10-K/A for the year

ended December 31, 2005, and PDI's periodic reports on Form 10-Q and current

reports on Form 8-K filed with the Securities and Exchange Commission since

January 1, 2006. The forward-looking statements in this press release are based

upon management's reasonable belief as of the date hereof. PDI undertakes no

obligation to revise or update publicly any forward-looking statements for

any

reason.