For

more information contact:

Stephen

P. Cotugno

Executive

Vice President-Corporate Development

PDI,

Inc.

201.574.8617

PDI,

Inc. Reports Second Quarter and Six Month 2006 Results

Saddle

River, New Jersey (August 1, 2006). PDI, Inc. (NASDAQ: PDII) a contract sales

and marketing services provider to the pharmaceutical industry, today announced

its second quarter and six month 2006 results.

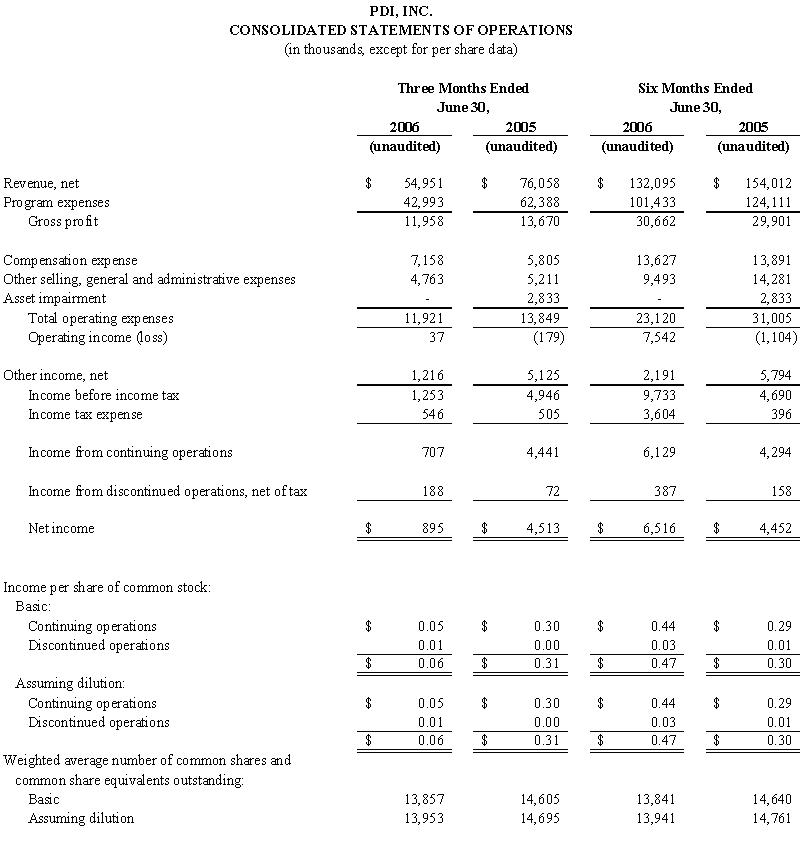

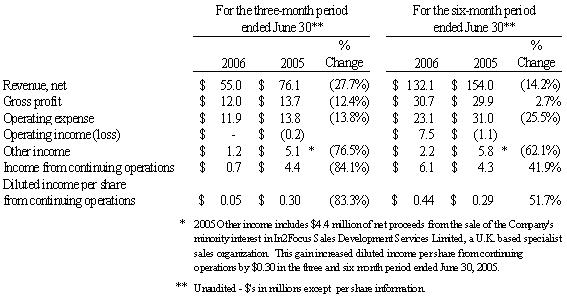

Continuing

Operations

Results

from continuing operations were:

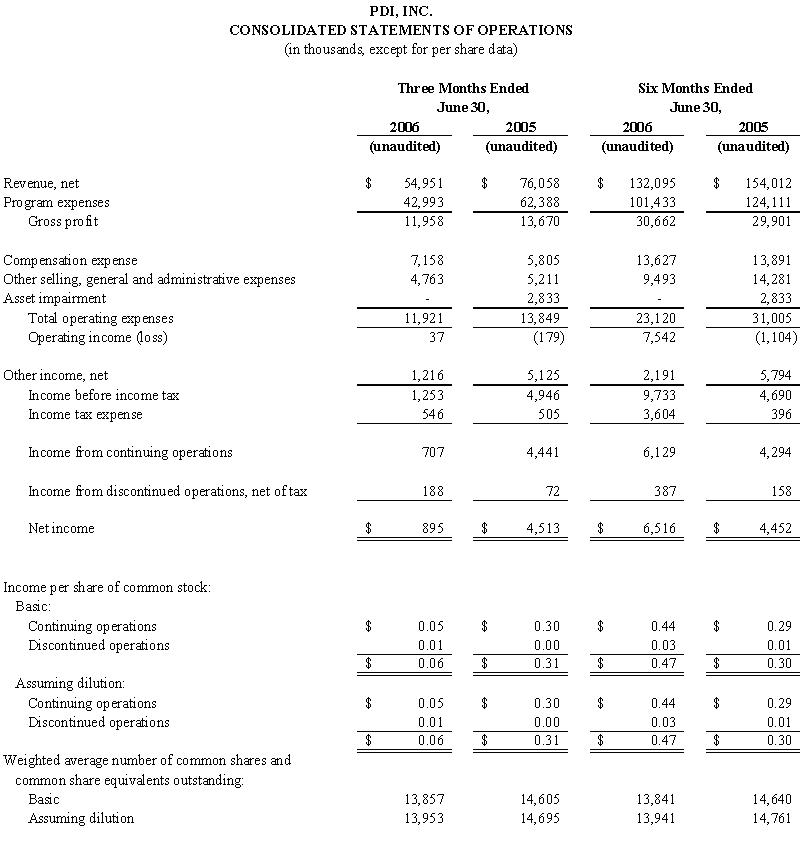

Revenue

-

The

decline in revenue for the second quarter and six months in 2006 compared to

2005 was primarily attributable to the scaling down, completion or termination

of certain contracts in the Company’s Sales Services segment, including the

previously announced termination of a major contract as of April 30, 2006.

New

contracts and expanded business with existing clients in this segment partially

offset these declines. Overall revenue in the Marketing Services segment

declined in the second quarter and six months of 2006 despite increased

Pharmakon revenue.

Gross

profit

- Lower

revenue reduced gross profit for the second quarter and six months in 2006.

In

addition, gross profit and the gross profit percentage were negatively impacted

by approximately $1.2 million in connection with start up costs for a new

contract sales engagement with a major pharmaceutical company announced on

May

11, 2006 and approximately $1.4 million due to a delay in revenue recognition

on

a contract sales engagement because of uncertainty regarding collection.

Offsetting these effects and despite lower revenue, gross profit attributable

to

the major contract terminated in the second quarter was higher in the second

quarter and six months of 2006 compared to 2005.

Operating

Expenses

- Total

operating expenses for the second quarter and six months of 2005 included a

$2.8

million charge for the write-down of a sales force automation system and a

$0.8

million reserve established for an outstanding loan. Operating expenses for

the

six month period in 2005 also included severance expenses of $1.3 million.

Net

legal expenses in the second quarter of 2006 were $1.8 million higher than

2005

primarily because of a $2.1 million litigation settlement received last year.

Net legal expenses were $0.7 million lower for the six months of 2006 compared

to 2005 due to lower outside counsel expenses, the receipt of additional amounts

for the litigation settlement and reversal of litigation reserves.

Discontinued

Operations - As

previously announced, the Company discontinued its Medical Device and

Diagnostics (MD&D) business unit, which included its InServe business,

during the second quarter of 2006. All prior periods have been adjusted to

reflect this business unit as a discontinued operation. Income from discontinued

operations, net of taxes, for the second quarter were $0.2 million in 2006

and

$0.1 million in 2005; and for the six months, were $0.4 million in 2006 and

$0.2

million in 2005.

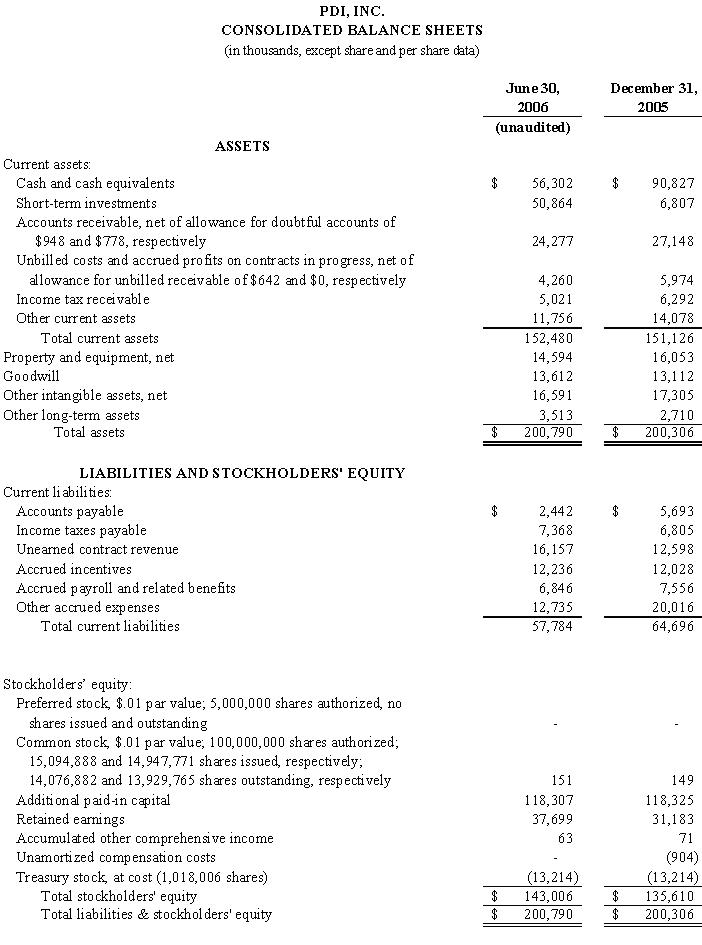

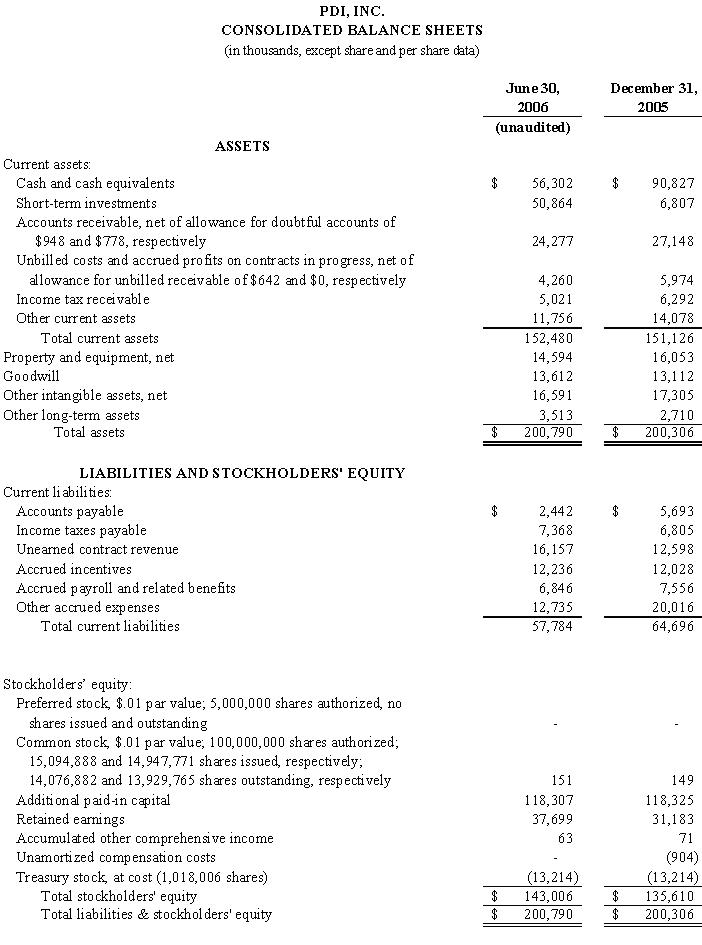

Liquidity

and Cash Flow

Cash

and

short-term investments at June 30, 2006 was $107.2 million. Cash flow from

operations for the second quarter was $6.9 million and $11.8 million for the

first six months of 2006.

CEO

Commentary

Mr.

Michael Marquard, PDI’s CEO stated, “I am very pleased to be leading PDI and its

excellent people. I have spent over thirty years in pharmaceutical sales and

marketing and I know PDI is recognized as an outstanding provider of contract

sales and marketing services. As I assume this responsibility, I want to take

this opportunity to thank Larry Ellberger for his leadership as interim CEO.

Larry made a significant contribution to PDI in his tenure and has helped us

prepare for the challenges and opportunities ahead. Larry will be leaving PDI

effective August 4, 2006 and we wish him all the best in his future

endeavors.’’

“My

management team and I are committed to delivering improved results. Revenue

is

currently not sufficient to generate acceptable profitability. In the short

term, our priorities are to support our strengthened business development

activities in order to generate top line growth and to continue to control

costs. We intend to focus on the actions necessary to re-establish our

leadership position within the contract sales industry, to grow our marketing

services businesses and to deliver improved shareholder value. We are actively

developing a strategic plan that will define our specific actions going

forward.”

“We

believe PDI is in a position to benefit from the use of our services by large

pharmaceutical companies and from the growing number of emerging pharmaceutical

companies that are seeking turnkey sales and marketing solutions. Efficient,

flexible and cost effective sales and marketing services will continue to be

critical as large and emerging pharmaceutical companies commercialize their

products in a heavily managed marketplace. PDI has an excellent reputation

of

providing top quality sales and marketing services.”

Conference

Call Information

PDI

will

conduct a briefing of its results via conference call and webcast on Wednesday,

August 2, 2006 at 9:00 AM eastern time. The webcast of the event will be

accessible through the Investor Relations section of PDI’s website, www.pdi-inc.com.

The

webcast will be archived on the website for future on-demand replay.

For

those

without internet access, the briefing can be accessed by dialing 1-877-423-4030

and asking for the PDI’s Second Quarter 2006 Financial Results Call. The call

play back will be available for two weeks by calling 1-800-642-1687 and entering

the call number 2834195.

About

PDI

PDI,

Inc.

(NASDAQ: PDII) is a contract sales and marketing services provider to the

pharmaceutical industry offering a comprehensive set of outsourced solutions

for

established and emerging pharmaceutical companies. PDI is dedicated to

maximizing the return on investment for its clients by providing strategic

flexibility; sales, marketing, and commercialization expertise; and a philosophy

of performance.

Headquartered

in Saddle River, NJ, PDI’s sales and marketing services include our Performance

Sales Teams™, which are dedicated teams for specific clients, and Select

Access™, our targeted sales solution that leverages an existing infrastructure.

PDI also offers marketing research and consulting services through TVG in

Dresher, PA, and medical communications services through Pharmakon in

Schaumburg, IL. In addition, PDI is a high quality provider of ACCME-accredited

continuing medical education through Vital Issues in Medicine (VIM ®) in

Dresher, PA. The company’s experience extends across multiple therapeutic

categories and includes office and hospital-based initiatives.

PDI’s

commitment is to deliver innovative solutions, unparalleled execution and

superior results for its clients. Through strategic partnership and

client-driven innovation, PDI maintains some of the longest standing sales

and

marketing relationships in the industry. Recognized as an industry pioneer,

PDI

remains committed to continuous innovation and to maintaining the industry’s

highest quality employees.

For

more

information, visit the Company’s website at www.pdi-inc.com.

Forward-Looking

Statements

This

press release contains forward-looking statements regarding future events and

financial performance. These statements involve a number of risks and

uncertainties and are based on numerous assumptions involving judgments with

respect to future economic, competitive and market conditions and future

business decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond PDI's control. Some of the important

factors that could cause actual results to differ materially from those

indicated by the forward-looking statements are general economic conditions,

the

termination of or material reduction in the size of any of our customer

contracts, the loss by our clients of intellectual property rights, our ability

or inability to secure new business to offset the recent loss of the AstraZeneca

program and the terms of any replacement business we secure, changes in our

operating expenses, FDA, legal or accounting developments, competitive

pressures, failure to meet performance benchmarks in significant contracts,

changes in customer and market requirements and standards, the impact of any

stock repurchase programs, the adequacy of the reserves PDI has taken, the

financial viability of certain companies whose debt and equity securities we

hold, the outcome of certain litigations, PDI's ability to implement its current

business plans, and the risk factors detailed from time to time in PDI's

periodic filings with the Securities and Exchange Commission, including without

limitation, PDI's Amended Annual Report on Form 10-K/A for the year ended

December 31, 2005, and PDI's periodic reports on Form 10-Q and current reports

on Form 8-K filed with the Securities and Exchange Commission since January

1,

2006. The forward looking-statements in this press release are based upon

management's reasonable belief as of the date hereof. PDI undertakes no

obligation to revise or update publicly any forward-looking statements for

any

reason.